NS-SPS 101 – Don’t Get Eff’d At Tax Time

Course Description

The first of four Sole-Prop SchoolTM courses, this is the keystone. The building block of your sole-proprietor financial universe. Don’t get blind-sided by a tax bill you can’t pay and learn what receipts you need to be keeping! This is a MEGA resource and life-saver for tax time preparations.

When you take this course you will know:

- The % of your earnings you should squirrel away for tax time

- How to reduce the amount of income taxes owing at tax time

- How to separate business expenses from personal expenses

- The different business expense categories how they work

- What receipts you need to be keeping

What you get:

- A customizable tool (spreadsheet obvs) that you can use each year to project out how much money you need to save for tax time as your business grows and changes.

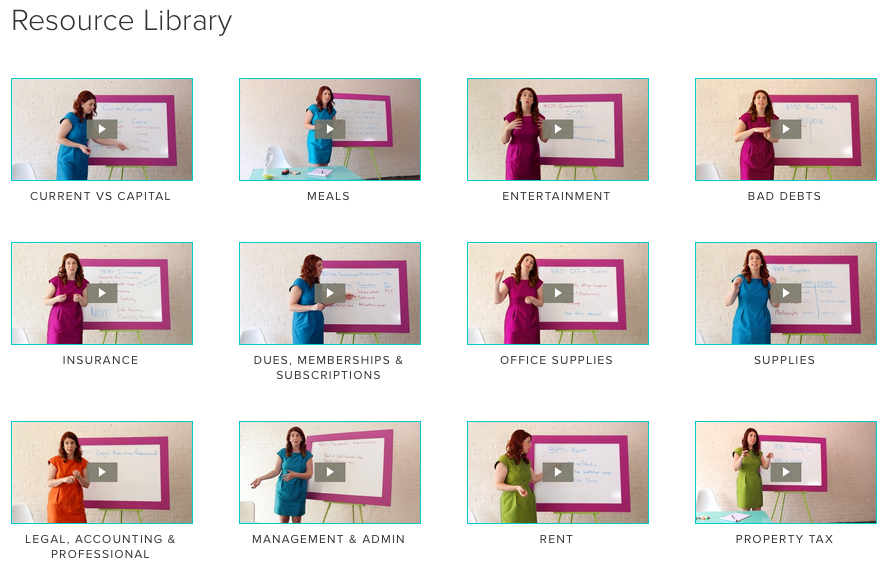

- Access to the ultimate EXPENSE RESOURCES LIBRARY. We break down each tax category is a quick video that explains what the category is, how it’s calculated on taxes and modern day examples of what will and won’t work as a biz expense (i.e. you can’t write off your daily coffee). See screencap below. You can refer to this whenever you want throughout the year and during tax time while you’re prepping your taxes!

Course FAQ

How Long Is The Course?

How will this save me money?

I have a tax professional, do I still need this course?

I have a bookkeeper, do I still need this course?

Pre-Requisites:

- Ability to open excel spreadsheet, PDF documents, online video streaming (aka the Internet)

This course is ideal for:

-

Most Canadian sole-proprietors (or those who are just starting out) who sell goods, services and digital products

-

Service-based sole-proprietors/freelancers, crafters, artisans, retail & online shops, bloggers, artists, info-preneurs, fitness-preneurs etc

$147

(or get all 4 sole proprietor courses for $397!)

“It was mind blowing. I found all of them [the modules] fun. They’re fun because your energy is fun. I LOVE that you can make the most difficult and “boring” really entertaining and fun to watch. The way that you present taxes made me actually WANT to tackle that part of my business instead of leaving it to the last minute. You’re super motivating.”

“I’m so happy I did it. I just did my 30 mins of bookkeeping for the month before answering this email and it feels damn good to be on top of my shit now. I get what I’m supposed to do! I feel lucky that you had this program out when you did, just in time for my first tax season as a sole prop. I’m a lucky lady. You’re great!”

“Thank YOU so so much for making me feel like I am not: a) incredibly unaware of how to run my business and b) not running a shoddy back alley flower shop. So glad to have your help and guidance ( huge sigh of relief)”

“Taking my business to the next level was stunted by my lack of confidence and knowledge in financials. Having a clear separation between my personal and business finances has made me take the business more seriously; transforming it from a weekend craft into an empire that supports me full time. I’m living the dream, and never have to count a receipt again thanks to Sole-Prop School!”

Meet Your Teacher

Shannon Lee Simmons

Shannon is a Certified Financial Planner (CFP), Chartered Investment Manager (CIM), media personality, personal finance expert and founder of the New School of FinanceTM. She loves helping everyday people survive the new economic climate through personal finance, ethical investing and small business advice. Simmons is widely recognized as a trailblazer in the Canadian financial planning industry and an expert in Millennial personal finances and the digital world and it’s relationship to our money. She was named one of Canada’s Top 30 Under 30 and she recently won the 2014 Notable Award for Best In Finance. She is a regular financial expert on CTV News and also appears as a financial expert in the media, a regular contributor for Toronto Star’s Money Makeover and BBC Capital and host of Coral TV’s Money Awesomeness. Shannon travels across the country speaking for some of Canada’s largest corporations and universities including IBM Canada, The Canadian Women’s Foundation, University of Toronto, Ryerson University and Bishops University to name a few.

NOT SO FINE PRINT

- Please ensure you have read the Pre-Requisites and Course Restrictions for this course before signing up

- This course is not financial or tax advice. The information in this course is for educational purposes only.

- The information in this course does NOT replace the information in the Income tax act or it’s Regulations.

- For all Quebec residents, the information given in this course is federally oriented and may not take specific tax differences for Quebec into account as Quebec residents may be subject to specific rules that are outside the scope of this course. We invite you to get in touch with us at info@newschooloffinance.com for more information before you purchase to confirm whether this course will suit your needs.

- Les renseignements fournis dans le cadre de ce cours concernent surtout le palier fédéral et peuvent ne pas tenir compte des différentes règles fiscales auxquelles sont soumis les résidents du Québec. Nous vous encourageons à communiquer avec nous à l’adresse info@newschooloffinance.com pour obtenir de plus amples renseignements avant votre inscription, afin de vérifier si ce cours vous convient.

- All courses will be charged in USD (based on that day’s USD equivalent to the CAD course price). Your credit card may charge you a different exchange rate or additional fees for foreign transactions.